The financial markets had plenty to cheer about this week. On Wednesday, Stocks rallied a stunning 1,000+ points, enjoying their best one-day gain in history and then rallied over 800 points higher intraday on Thursday, erasing a huge midday loss. All in

Dec 28, 2018 | Mortgage News

For many people, their home is their largest asset. And its value generally grows over time, producing more equity for the homeowners. How can homeowners make use of this equity without selling their house? A home equity loan or a home equity line of cred

Dec 26, 2018 | Home Equity Loans

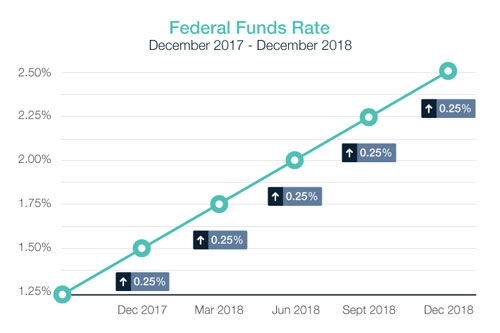

"Hut One, Hut Two... HIKE!" It was all about the Fed this past week. On Wednesday, they "hiked" the Fed Funds Rate by 25 basis points (0.25 percent). That rate affects short-term loans like auto and credit cards - what it doesn&

Dec 22, 2018 | Mortgage News

When interest rates increase borrowing money becomes more expensive for all sorts of things, including homes. Although this makes it more expensive to buy big-ticket items, it’s not all bad. As interest rates rise, the interest rates on the money th

Dec 20, 2018 | Refinancing a Home Home Equity Loans Reverse Mortgage

All of us at Advanced Funding Home Mortgage Loans would like to wish you a Merry Christmas and a Happy New Year! We would like to thank you for making 2018 a great year and for the privilege of helping you purchase or refinance your home. We hope that 20

Dec 19, 2018 |

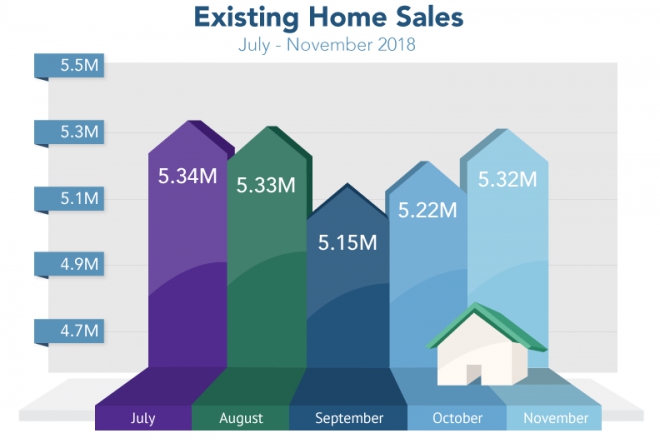

The National Association of REALTORS® (NAR) reports that Existing Home sales in November rose 1.9 percent from October to an annual rate of 5.32 million units versus the 5.20 million expected. Gains were seen in the Northeast, Midwest and South w

Dec 19, 2018 | Mortgage News