"Hut One, Hut Two... HIKE!"

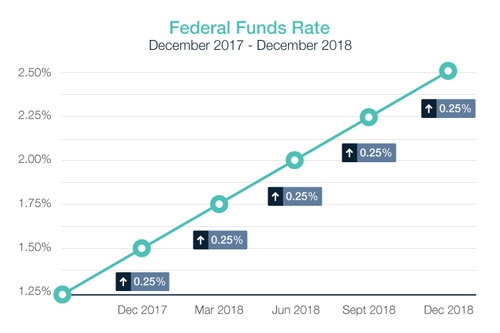

It was all about the Fed this past week. On Wednesday, they "hiked" the Fed Funds Rate by 25 basis points (0.25 percent). That rate affects short-term loans like auto and credit cards - what it doesn't affect are home loan rates.

Home loan rates actually improved to the best levels since April. Why?

The Fed Statement suggested that inflation is moderating and remains beneath the Fed's target of two percent year over year.

If Inflation remains low, long term rates - like mortgages, will also remain relatively low.

Also helping home loan rates improve was a big sell-off in Stocks. The Stock market hated the Fed Monetary Policy Statement which suggested more hikes next year, despite acknowledging low inflation and slowing economic conditions around the globe.

Stocks don't like Fed rate hikes as they weigh on economic growth due to added costs of financing.

Bottom line - home loan rates moved nicely lower this past week representing the best time since spring to either purchase or refinance a home.

Additional Information >

Vantage Production, LLC is the copyright owner or licensee of the content and/or information in this post, unless otherwise indicated.