Social media can be a marketing boon, but coming up with ways to engage people isn't always easy. Below are two free and easy-to-implement ideas that will help you stand out from the crowd. Educate Clients with a Private Facebook Group Build

Nov 07, 2018 |

Mortgage lenders loosened their mortgage credit standards in October, according to data from the Mortgage Bankers Association. The MBA’s Mortgage Credit Availability Index rose to 186.7, up 2.5% from 182.1 in September and 181 in October 2017. That

Nov 07, 2018 | Mortgage News

The Federal Trade Commission (FTC) and the National Association of REALTORS® have announced concerns over closing cost scams, including scams in Utah.Here's how the scam works: Hackers break into a consumer's or real estate professional's email accoun

Nov 07, 2018 | Mortgage News

As a Utah real estate professional, you know that your greatest resource is your time. And time, if left unchecked, has a tendency to slip away under the stress of the day-to-day grind. Between texts, emails, phone calls, and meetings, it’s easy to

Nov 06, 2018 |

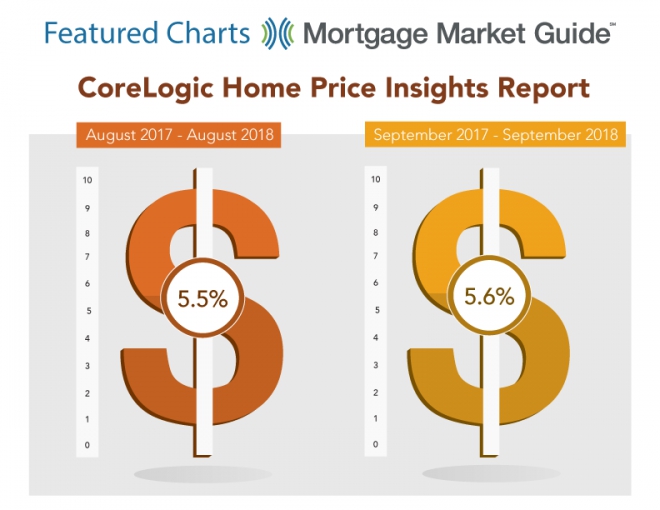

CoreLogic reports that home prices nationwide, including distressed sales, rose 5.6 percent year over year in September 2018 compared to September 2017. The 5.6 percent is down from June's 7.1 percent year over year increase as home price gains modera

Nov 06, 2018 | Mortgage News

"Workin' 9 to 5, what a way to make a livin'"- 9 to 5, Dolly Parton This past week showed more and more people working 9 to 5 and home loan rates didn't like it. First, the ADP Report on Wednesday showed 224,000 private jobs create

Nov 02, 2018 | Mortgage News