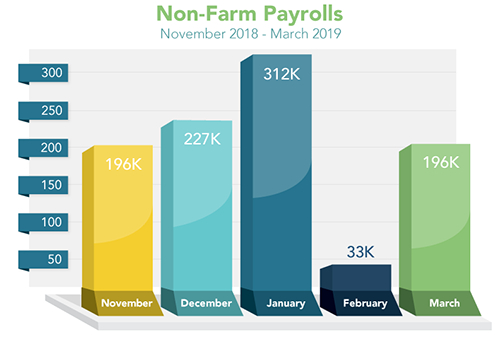

The Bureau of Labor Statistics reports that payroll growth rebounded in March after the weak reading in February. Non-Farm Payrolls rose 196,000 last month, above the 175,000 expected and above the 33,000 created in February. For January and February, upward revisions totaled 14,000. The Unemployment rate remained at 3.8%, near 50-year lows. Hourly earnings rose 3.2% year-over-year, down from 3.4% in February. Overall, a solid report with average job growth at 180,000 for the first three months of 2019.

Spring is the peak homebuying season for many parts of the country. After years of softer home sale activity - thanks to low housing inventory, affordability issues, and more - this Spring home buying season could prove to be one of the best in years. Why?

Call it the "Goldilocks" economic scenario - and here are several bullets that should help the Utah housing market and not just this Spring, but for the foreseeable future:

- The Fed has stated they will not raise rates in 2019. Yay!!! There is actually a better chance of a rate cut before 2019 comes to an end. This means home loan rates won't go too high.

- Inflation remains subdued - for now. Low inflation means lower rates.

- Home price gains are slowing year-over-year to healthier levels, and at equilibrium with personal wage gains. In years past, housing prices were gaining 10% to 15% or more, and wages were growing at 2%. Now we are seeing house prices increase 4% to 5% year-over-year, just slightly more than wages.

- Housing inventory is increasing. This is a big change from years past and should it continue, buyers will continue to come to the market and take advantage of the "Goldilocks" conditions.

- The Labor market remains solid. People buy homes because they feel good about their job and their future. Unemployment is at a 50-year low. This is very positive for housing.

- Europe can't get out of their own way. Their economies are weak and that is keeping their bonds yields ultra-low. This is putting downward pressure on US Bond yields. Yes - you can thank Europeans for your low home loan rates.

- The Stock market is right at all-time highs. This means higher 401K and IRA values create a positive wealth effect that should provide a nice tailwind for housing. People with money spend it.

- Consumer Confidence and Sentiment are increasing again thanks to the Fed no longer hiking rates, the strong job market, and Stocks up nicely in 2019. "Confident" consumers purchase homes.

- No fear of a US recession as Friday's March Jobs Report showed 196,000 new jobs created, a great rebound higher from February's 33,000 - which had stoked some recession chatter.

Home loan rates continue to hover near 14-month lows, thanks to the many bullets above.

Inquire Now

Vantage Production, LLC is the copyright owner or licensee of the content and/or information in this post, unless otherwise indicated.