For eligible active-duty service members, veterans and surviving spouses, the VA loan is a really good deal if you’re looking to buy a home in Utah. Its benefits include a 0% down payment and a funding fee that can be paid at closing or rolled into the loan instead of mortgage insurance.

You may be familiar with the fact that lenders take a look at your monthly debt payments in order to help determine how much house you can afford. However, VA loans also take into account the concept of residual income. Before we get to that, let’s touch on the basics.

What’s the Debt-to-Income Ratio for a VA Loan?

The VA generally recommends a debt-to-income (DTI) ratio of no greater than 41% with your mortgage payment included. It’s not a line in the sand, for reasons we’ll get into below, but it’s important to keep an eye on it. DTI is a comparison of your monthly debt payments to your monthly income. It includes any monthly credit card payments, car payments, student loans, personal loans, and your mortgage payment.

The minimum monthly payment on all of these debts is compared to your monthly gross income to determine the monthly mortgage payment you can afford.

In addition to DTI, one concept that’s unique to VA and some FHA loans is the idea of residual income qualification.

What Is Residual Income?

Residual income is sometimes confused with DTI. However, the Department of Veterans Affairs also wants to make certain that you have enough money left over to take care of your day-to-day expenses.

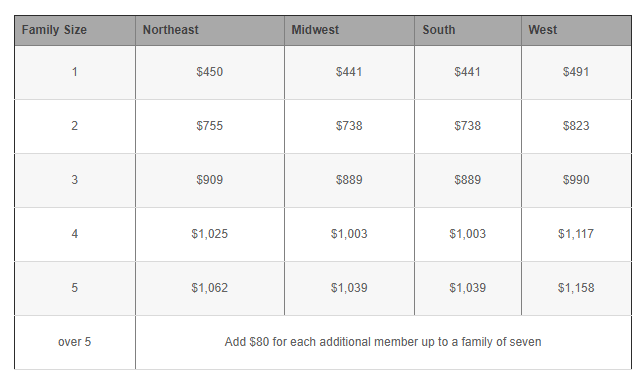

In order to qualify for a VA loan, you must meet a specific residual income threshold, which varies depending on the size of your family and where you live.

For loan amounts of $80,000 and above, residual income must exceed:

How Do You Calculate Residual Income?

Residual income is simply what’s left over after all your expenses are paid. To calculate the number, you simply subtract all the bills mentioned above that make up your DTI ratio.

The VA’s minimum residual income is considered a guide and should not trigger an approval or rejection of a VA loan on its own. Instead, it’s most often considered in conjunction with other credit factors. The DTI ratio and residual income are decidedly different, but they have an effect on each other.

While it’s possible to qualify with a DTI ratio that’s more than 41%, you must exceed the regional residual income requirement by at least 20%. So, if you have a family of four and you live in Utah, your regional residual requirement is $1,117. If your DTI ratio is 43%, you now must have a residual income of $1,340 to be approved for a VA loan.

Understanding the DTI ratio and residual income balance can be difficult. That’s why it’s so very important to work with a Utah mortgage broker who is experienced in dealing with VA loans. One of our mortgage loan advisors would be happy to explain the details that reflect your unique financial situation and help you make any necessary adjustments in your budget so that you may qualify for a VA loan.

Hopefully this has helped with your awareness of residual income requirements. If you would like to apply to buy a home or refinance your current one, you can get an approval online or give us a call at (801) 272-0600.