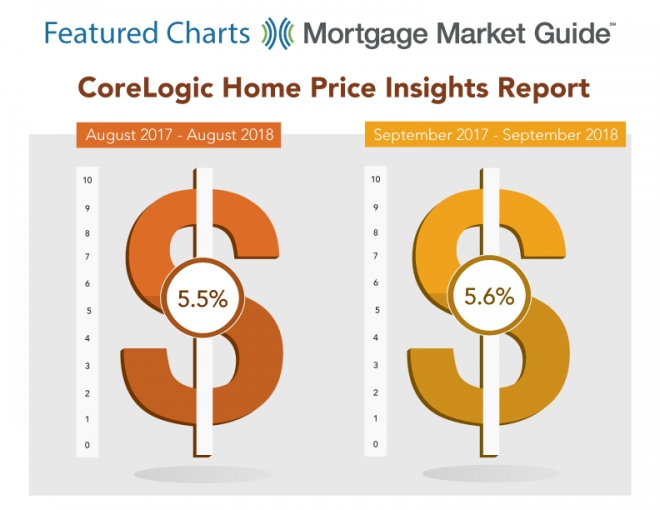

CoreLogic reports that home prices nationwide, including distressed sales, rose 5.6 percent year over year in September 2018 compared to September 2017. The 5.6 percent is down from June's 7.1 percent year over year increase as home price gains modera

Nov 06, 2018 | Mortgage News

You're planning on buying a home in the new future when your lease is up. You don't have much saved for a down payment due to recently getting married. So you're considering asking a family member for a gift for your down payment. You mi

Nov 02, 2018 | Home Buying or Selling First-time Homebuyers

"Workin' 9 to 5, what a way to make a livin'"- 9 to 5, Dolly Parton This past week showed more and more people working 9 to 5 and home loan rates didn't like it. First, the ADP Report on Wednesday showed 224,000 private jobs create

Nov 02, 2018 | Mortgage News

The average rate on a 30-year fixed rate mortgage fell to 4.83% in the latest week, according to mortgage guarantor Freddie Mac, down from 4.86% the week before. Investors flocked to bonds for safety as the stock market tumbled, and mortgage rates typical

Nov 01, 2018 | Mortgage News

The number of “zombie foreclosures” – vacant properties in the foreclosure process – fell to 10,291 homes, down 4.18% during the 2018 third quarter from a year earlier. The new total represents just 3.38% of all properties in forec

Oct 31, 2018 | Mortgage News

Your credit score can impact you in a number of different ways. It will affect the interest rate you pay on your mortgage, your insurance premiums, as well as the cost of consumer loans. Having a clear understanding of credit scores and knowing how to ach

Oct 30, 2018 | Credit Mortgage Basics