According to Julie Lythcott-Haims, author of “How to Raise an Adult,” having your child do chores is one of the best ways to help them succeed in life. When they understand that their contributions are a major factor in the happiness and

Feb 05, 2019 | Lifestyle

The Fed met this past week. As expected, they didn't hike rates and the Fed Statement was very "dovish," suggesting that rate hikes will be off the table for most, if not all, of 2019. The Fed looked to "muted inflation" and slowi

Feb 01, 2019 | Mortgage News

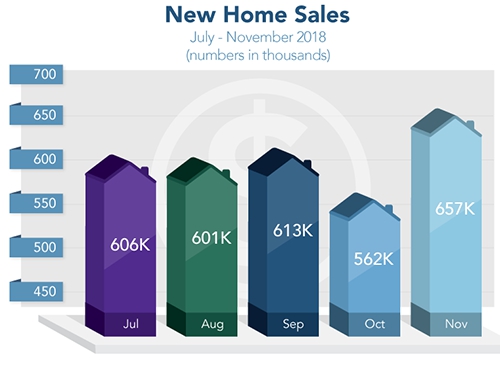

The partial government shutdown ended last Friday so the delay of sales of newly built homes for November was reported today with a big number. November New Homes Sales jumped 17% from October to an annual rate of 657,000 units, well above the 555,000 exp

Jan 31, 2019 | Mortgage News

Mortgage rates fluctuate from week to week and they can make huge swings from decade to decade. In the early 1980s, for example, mortgage rates were as high as 18% while roughly 30 years later they are less than a third of that rate. What causes Utah inte

Jan 30, 2019 | Mortgage Basics Interest Rates

Your credit score is an important part of getting a mortgage, your Utah mortgage will want to see your history of using and repaying credit to assess your viability as a borrower beforehand. Some extremely unfortunate souls have run into a worrisome issue

Jan 28, 2019 | Credit

Adjustable rate mortgage (ARM) loans always grow in popularity when interest rates are on the rise. Some borrowers think ARMs are the best way to save money on their mortgage in a higher rate climate. ARM loans can also be helpful for those who do not pla

Jan 23, 2019 | Mortgage Basics Interest Rates