The ongoing and unresolved US/China trade turmoil is the biggest story to follow right now. The uncertainty and negative headlines associated with the negotiations have pushed Stocks lower for most of May, with Bonds and home loan rates being the beneficiary.

We would like to think that the talks over the past year or so will bring forth a positive agreement -- but it's unclear whether this will come to pass. The next round of talks is scheduled for June 28-29 at the G20 meeting, so there is likely to be no progress before this time. If that is the case, US interest rates will remain near multi-year lows.

One thing's for sure...the Fed will not be hiking rates anytime soon if this trade turmoil goes unresolved or escalates. In fact, there's actually a chance we see a Fed rate cut in 2019 -- especially if the US economy reacts poorly to the US/China trade dispute.

It's important to understand that this story, while very negative and uncertain at the moment, could change very quickly. If a positive resolution comes to pass, we should expect stocks to reclaim all of their recent losses and more -- all at the expense of bonds and home loan rates.

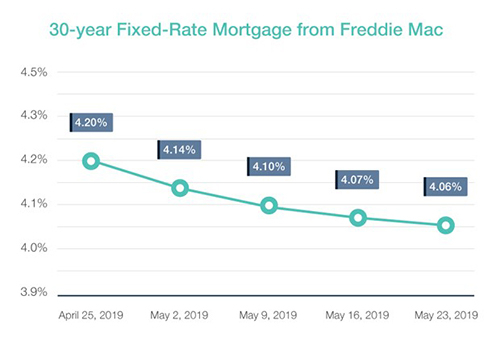

Bottom line: Home mortgage rates are back near 16-month lows and coupled with the current strong US economic backdrop, it is an incredible moment to either refinance or purchase a home.

Get a Lower Interest Rate

Inquire Now

Vantage Production, LLC is the copyright owner or licensee of the content and/or information in this post, unless otherwise indicated.