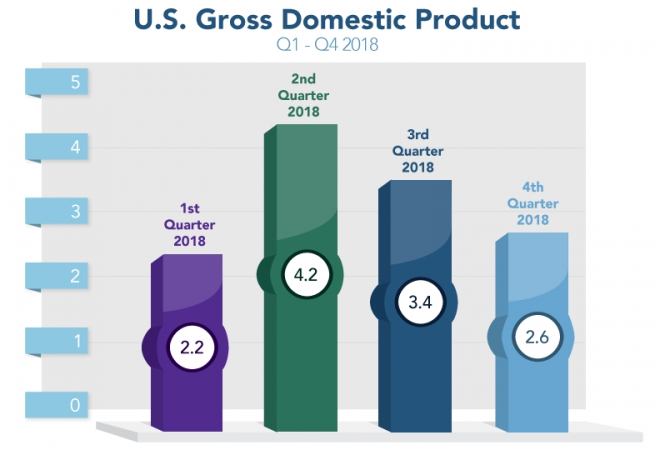

This past week, the Bureau of Economic Analysis (BEA) reported the U.S. economy, as defined by Gross Domestic Product (GDP), grew at a 2.6% rate in the fourth quarter of 2018. Economists and the markets were expecting 2.0% to 2.3%, so this was a nice upside surprise.

This left GDP for all of 2018 at 2.9%. Consumer spending, which makes up nearly two-thirds of GDP, expanded by a solid 2.8% in the fourth quarter - yet slower than the previous quarter.

Another solid number within the report was business investment which grew at a swift 6.2% pace.

This Q4 GDP reading was the first of three - so we will see some revisions in the months ahead.

Seeing the economy grow at such a nice clip despite high stock market volatility and the U.S. government shutdown is a good sign as we head into the spring housing market.

The increased wealth effect caused by the recent rally in Stocks along with one-year lows on home loan rates, rising wages and increased housing inventory sets the stage for an improved 2019 housing market.

Additional Information >

Get a Lower Interest Rate

Get Quote

Vantage Production, LLC is the copyright owner or licensee of the content and/or information in this post, unless otherwise indicated.