"Let the Good Times Roll" - Good Times Roll by The Cars

For the sixth consecutive week, home loan rates declined, once again fueled by the ongoing trade tensions between the US and China.

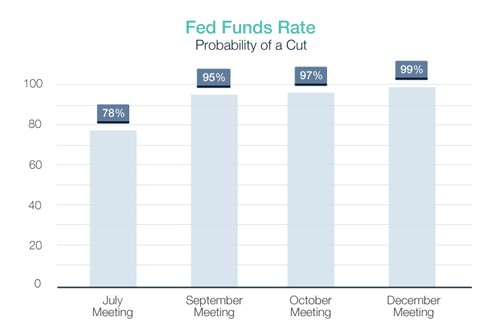

However, the decline in rates was halted on the notion the Fed is likely to CUT rates soon. Huh? That's right - a couple of Federal Reserve members were speaking this week and suggested that the time might be right for a Fed rate cut.

How come home loan rates didn't improve further upon news? When the Fed cuts or lowers rates, they can only lower the Fed Funds Rate, which is an overnight lending rate between banks. The Fed doesn't control home loan rates.

When the Fed cuts rates it is doing so to fuel economic growth and/or allow inflation to rise -- both of these are bad for long-term rates like home loan rates. Additionally, Stocks love Fed rate cuts and moved nicely higher midweek, taking money out of Bonds thereby limiting their decline in yield or rates.

The ongoing trade tensions and slowing growth around the globe may very well continue to push home loan rates lower in the weeks and months ahead -- but we must now pay attention to the Fed who will look to "help" the Stock market from further declines by cutting rates. And anything that helps Stocks is usually not great for home loan rates.

Bottom line - we are staring at 2-year lows in home loan rates and the time could not be much better to lock in on a purchase or refinance loan.

If you or someone you know has questions about Utah home loans, give us a call. We'd be happy to help, 801.272.0600.

Additional Information >

Inquire Now

Vantage Production, LLC is the copyright owner or licensee of the content and/or information in this post, unless otherwise indicated.