"It's a small world after all"

If inflation moves lower or is expected to move lower - rates must go lower as well. That's the situation right now.

The financial markets and interest rates also follow inflation on a global scale. Why is this important to homeowners?

If disinflation or the rate of inflation moderates in places like Europe, interest rates in those countries move lower and tend to drag US interest rates lower as well.

This past week we watched home loan rates revisit one-year lows upon news that the European Central Bank or ECB downgraded their economic outlook and inflation expectations.

The ECB said they now expect 2019 economic growth to come in at a paltry 1.1%, down sharply from a previous forecast of 1.7%. Moreover, ECB officials said inflation, which is already very low, could move lower still.

Again, if inflation moves lower in large countries around the globe -- we tend to see improvement in long-term US interest rates...that is the current trend.

Interest rates don't buy houses, jobs do!

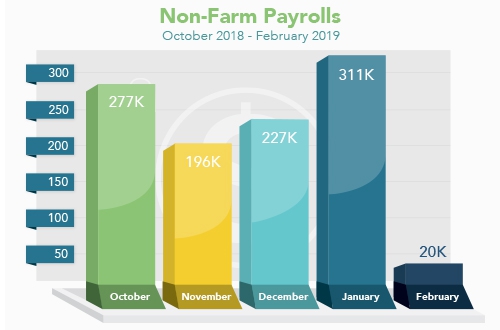

The Bureau of Labor Statistics reported that just 20,000 jobs were created in February, well below expectations of 175,000. This was a disappointing number, but the unemployment rate fell to 3.8% and wages grew by 3.4% year over year...the highest level in a decade. Overall the labor market continues to expand and wages are rising -- all good news for housing.

Additional Information >

Get a Lower Interest Rate

Get Quote

Vantage Production, LLC is the copyright owner or licensee of the content and/or information in this post, unless otherwise indicated.