After sitting down at the mortgage closing table to sign all the paperwork, you get the keys and can breathe a sigh of relief. But before you tuck all those mortgage papers away for good, there are at least five things you still need to do after closing t

Mar 13, 2019 | Mortgage Basics Homeowner Tips

Your mortgage can be a very powerful financial tool that can help you in a variety of situations. The major way you take advantage of the built-up equity and other financial power is by refinancing your home. But when should you do it? Are there any

Mar 12, 2019 |

Your home is probably your largest asset and your mortgage payment is more than likely one of your largest expenses each month. When looking at these numbers do you feel like your monthly mortgage payment is too high? If so, here are a few ways to lower y

Mar 10, 2019 | Refinancing a Home Mortgage Basics

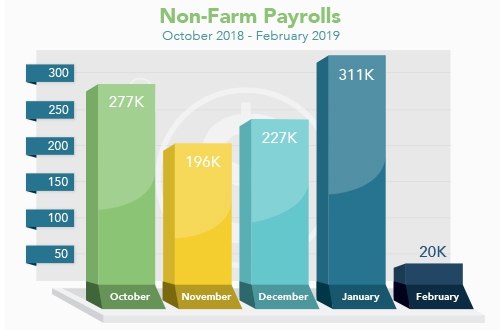

"It's a small world after all" If inflation moves lower or is expected to move lower - rates must go lower as well. That's the situation right now. The financial markets and interest rates also follow inflation on a global scale.

Mar 08, 2019 | Mortgage News

How much you will pay for a mortgage loan and even whether you can qualify for a mortgage will have a lot to do with your credit score. Higher credit scores will help you get the best terms possible while lower scores could keep you from your dream of hom

Mar 06, 2019 | Interest Rates Credit

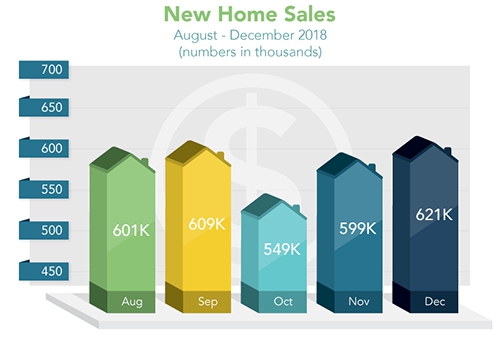

The Census Bureau reports that New Home Sales rose 3.7% in December to an annual rate of 621,000 units, a seven-month high and above the 572,000 expected. Sales were down 2.4% from December 2017 to December 2018 while sales for November were revised lower

Mar 05, 2019 | Mortgage News